Financial Wellness Programs

Both employers and employees agree that financial wellness programs have value, but disconnects between employers’ approaches and what employees want out of the programs impair their value.

That’s according to the 2018 Bank of America Merrill Lynch Workplace Benefits Report, which finds that just a third of employees actually participate in such programs, even though many are having a hard time financially.

In fact, 38 percent of employees believe they’re not doing well financially, and it’s worse among younger workers—with 44 percent of workers under 40 saying their finances aren’t in good shape.

And while employees want help with long-term financial goals, such as ways to help them save and invest for the future, employers are focused on workers’ immediate financial needs and think budgeting and learning to handle expenses are more useful. In fact, employees say that advice and plans from a professional would be the biggest help in straightening out their finances.

Health enters into the problem, too, with just 7 percent of employees believing that health care is an important element of financial wellness. Meanwhile, 53 percent of employees have skipped or postponed at least one health care issue, such as a doctor’s appointment or filling a prescription, to save money.

For more information see the original article: Poor engagement hinders financial wellness programs’ value | BenefitsPRO

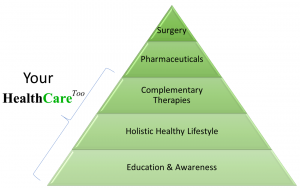

Our Model